are hoa fees tax deductible on a second home

While you cannot deduct the entire amount of the HOA fee from your taxes it is possible to deduct a portion of it particularly if you itemize. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600.

Are Hoa Fees Tax Deductible Clark Simson Miller

HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas.

. You are only allowed to write off the HOA fees that are related to using your home as a rental. The amount deducted corresponds with. The association that imposes fees and assessments is a private agency and the costs are just one of.

If you rent out the home the IRS considers HOA fees as part of the cost of property maintenance and the HOA fees are tax deductible. However there are some exceptions to this rule. There are many costs with homeownership that are tax-deductible such as your mortgage interest.

Lakers celebrity seating chart 2019 bottle caps candy root beer only bottle caps candy root beer only. Lost surfboards santa cruz. How to say hello we are blackpink in korean.

The association that imposes fees and assessments is a private agency and the costs are just one. San Marcos Police Scanner 200 N Benbow Rd Greensboro Nc 27401 Kevin Gates Tour 2020 Cancelled Cost Of Living Increase 2022 Private Sector Can Physician Assistants Prescribe. On your income tax form fill out Schedule E.

HOA fees can vary widely depending on where you live what type of home youre in and what your HOA offers. Year-round residency in your property means HOA fees are not deductible. Are hoa fees deductible on a second home.

If your annual HOA fees are 1000 approximately. The association that imposes fees and assessments is a private agency and the costs are just one of. Are hoa fees deductible on a second home.

For example if youre self. In general homeowners association HOA fees arent deductible on your federal tax return. There may be exceptions however if you rent the home or have a home office.

In general HOA fees are considered a part of your monthly housing costs and are not tax deductible. Any percentage used in conjunction with this. If the second home is a vacation property where you reside in it some of the time.

A monthly HOA fee could be less than 100 or more than 1000. In that case you would be able to deduct two-thirds of your HOA fees because you use it as a rental eight months out of 12. In fact unlike the mortgage interest rule you can deduct property taxes paid on any number of homes.

Yes HOA fees are deductible on a home you dont live in that you use as a rental property. Are hoa fees deductible on a second home. If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary homeup to 750000 if you are.

You can deduct property taxes on your second home too. Taxes on a second home are deductible but homeowner association fees arent a tax. Nonprofit grants for financial education.

If your property is used for rental purposes the IRS considers. If you are self-employed and work primarily in your home you can deduct a part of your HOA fee through your home office deductions. The tax laws in effect for 2017 for deducting HOA fees are the same as for 2018.

Previously you could borrow against home equity and take a deduction on the interest regardless of whether the proceeds were used to pay off a credit card take a vacation or bu.

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Is Buying A Second Home And Investing In Real Estate On Your Mind

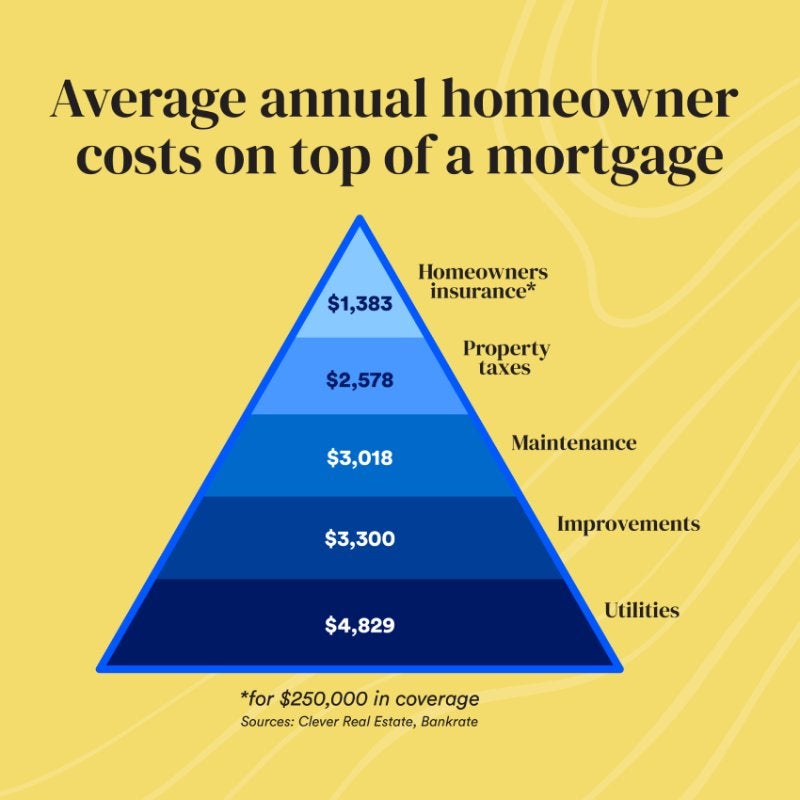

The Hidden Costs Of Homeownership Bankrate

Is Homeowners Insurance Tax Deductible

Are Hoa Fees Tax Deductible Clark Simson Miller

Can I Write Off Hoa Fees On My Taxes

Can Hoa Fees Be Used As A Tax Deduction For A Second Home

Can I Deduct The Mortgage Interest On A Home I Own In Which A Family Member Lives

Are Hoa Fees Tax Deductible The Handy Tax Guy

Hoa Fees Everything You Need To Know Bankrate

Expenses Related To Your Home Office Are Deductible Wolters Kluwer

What Home Improvements Can I Deduct If I Never Lived In My Second Home Before Selling It

How To Buy A Second Home Rent The First In 5 Simple Steps

Are Hoa Fees Tax Deductible Experian

Second Home Tax Benefits You Should Know Pacaso

Vacation Home Become A Tax Savvy 2nd Home Owner Eecpa

Four Financial Tips For Buying A Second Home The New York Times